Estonia company formation

Estonia, a small but mighty country in Northern Europe, has become a hot spot for entrepreneurs and investors worldwide, thanks to its advanced digital society, business-friendly policies, and simple company formation procedures. This article aims to guide you through the process of Estonia company formation, offering detailed insights about everything you need to know.

Why Choose Estonia for Company Formation

Estonia boasts a modern and transparent business environment, consistently ranking high in ease of doing business reports. The country offers a unique e-Residency program that allows non-Estonians access to Estonian services such as company formation, banking, payment processing, and taxation. The digital society, advanced IT infrastructure, and low corruption rate are other compelling reasons to consider Estonia for company formation.

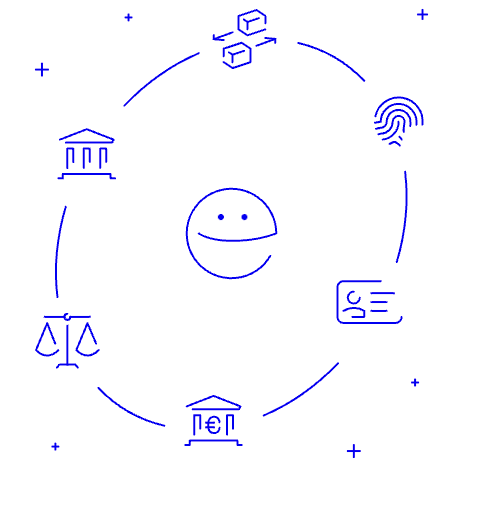

Process of Estonia Company Formation

The process of forming a company in Estonia is simple and straightforward. Most importantly, it can be done entirely online. However, it’s essential to understand the steps involved, eligibility criteria, documents required, and the type of companies that can be formed.

Eligibility Criteria

To form a company in Estonia, you must be over 18 years old. Non-residents can also form a company with the e-Residency program. However, certain types of businesses may require special licenses and permissions.

Types of Companies in Estonia

Estonia allows the formation of various types of companies including Private Limited Companies (OÜ), Public Limited Companies (AS), General Partnerships (TÜ), and Sole Proprietorships (FIE). Each type has its own set of rules, advantages, and disadvantages.

Benefits of a Digital E-Residency

The Estonian e-Residency program offers numerous benefits. E-Residents get a digital ID that allows them to start and manage an EU-based company online. They also gain access to Estonia’s transparent business environment and digital services.

Steps to Obtain an E-Residency

Obtaining an e-Residency involves applying online, paying the state fee, and picking up the digital ID card from an Estonian Embassy or Consulate. The whole process takes about a month.

Documents Required for Company Formation

The key documents required for Estonia company formation include a valid passport, proof of address, and the business plan. For some businesses, additional licenses and permissions might be needed.

Registration Process and Timeframe

After gathering the necessary documents and obtaining the e-Residency, you can start the registration process. This involves choosing a unique company name, specifying the business field, and providing share capital information. The whole process typically takes a few days.

Tax System in Estonia

Estonia has a unique tax system where corporate income tax is charged only on distributed profits. This allows businesses to reinvest their profits without any additional tax burden. Estonia also has double taxation treaties with many countries, ensuring no income is taxed twice.

Virtual Office in Estonia

If you are an e-resident, you can set up a virtual office in Estonia. This includes an official company address and mail handling services. Some providers also offer additional services like accounting and legal support.

Banking and Finance in Estonia

Estonia offers a wide range of banking and financial services for businesses. Many banks allow e-residents to open an account online. In addition, there are various fintech companies that offer business banking solutions.

Business Environment in Estonia

Estonia provides a supportive and stable business environment with a well-functioning legal system and robust protection for investors. The country is also known for its innovative and tech-savvy workforce, making it an ideal place for businesses in the IT sector.

Conclusion

Forming a company in Estonia comes with a multitude of benefits, ranging from its digital services to its transparent business environment. While the process might seem daunting at first, understanding the steps and requirements can simplify it significantly.

FAQs

Can a non-resident form a company in Estonia?

Yes, Estonia’s unique e-Residency program allows non-residents to form and manage an Estonian company online.

What types of companies can be formed in Estonia?

Estonia allows the formation of various types of companies, including Private Limited Companies (OÜ), Public Limited Companies (AS), General Partnerships (TÜ), and Sole Proprietorships (FIE).

How long does it take to form a company in Estonia?

The whole process, from obtaining an e-Residency to registering the company, typically takes about 1-2 months.

What is the tax system like in Estonia?

Estonia has a unique corporate tax system where tax is only charged on distributed profits. Undistributed profits can be reinvested tax-free.

Can I open a bank account in Estonia as an e-resident?

Yes, many Estonian banks allow e-residents to open an account online. There are also fintech companies that offer business banking solutions to e-residents.